Experience a complete, end-to-end Financial Crime Management platform that simplifies complex due diligence. Powered by advanced technology and supported by the most comprehensive data in the industry, our solution uncovers hidden risks, streamlines compliance, and empowers smarter decisions. From onboarding and ongoing monitoring to detailed investigations, manage every stage with ease and confidence - keeping your organisation secure and ahead of evolving threats.

Scroll down to explore the full breadth of our capabilities.

Powered by advanced AI and unrivalled data, we offer end-to-end financial crime prevention. From instant KYC screening and continuous monitoring to deep enhanced due diligence and identity verification, we help firms uncover risks quickly and thoroughly. Combining technology with expert support, we enable you to stay ahead in a complex risk landscape with ease.

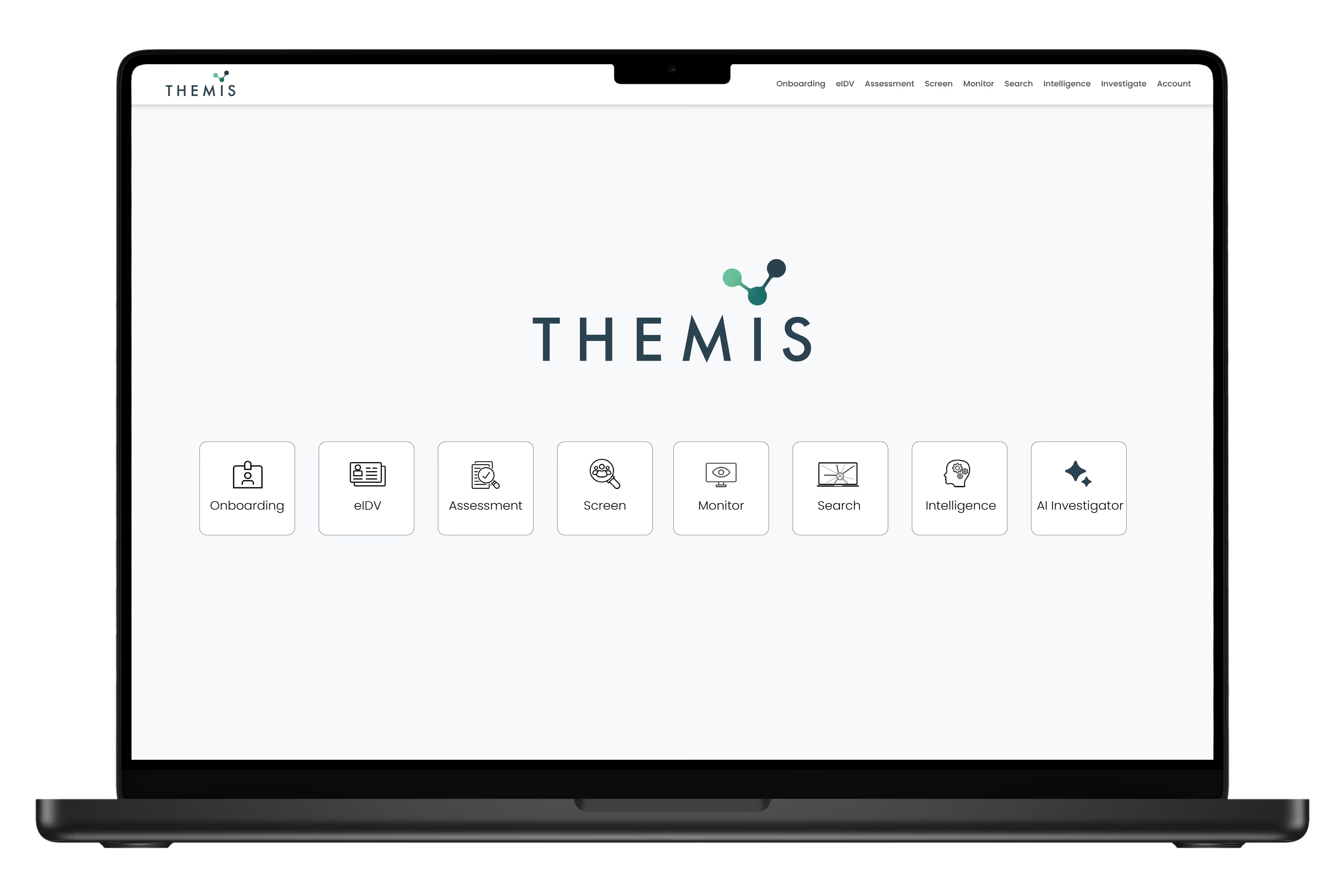

Screening, monitoring, and investigations in a single platform

An intuitive, online tool that helps you create a proactive & positive anti-financial crime culture and meet your regulatory challenges

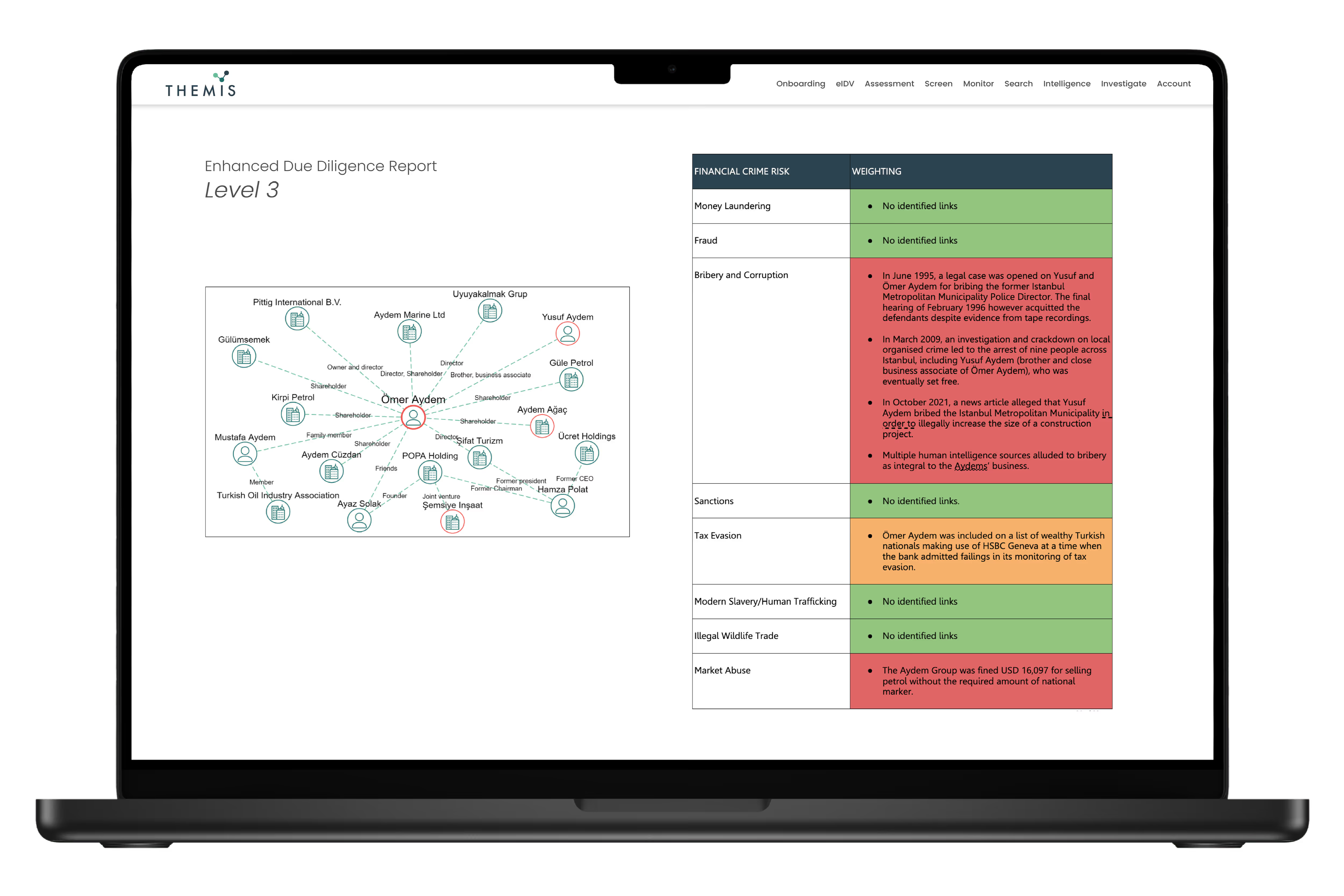

Request in-depth Level 1, 2 & 3 Enhanced Due Diligence reports on any entity, anywhere

Dedicated Account Manager to guide you through the process

API and bulk upload capabilities for seamless workflows

Empower insiders to report misconduct, protecting the financial system and enabling early intervention against fraud, bribery, and other crimes.

A clear overview of activity, risk levels, and due diligence, supporting compliance and informed relationship management.

Auto-generates audit-ready reports, ensuring full traceability and instant access during internal reviews or regulatory inspections.

Tailored support and Strategic guidance ensuring you get the most value from the platform

The Themis Platform combines data, technology, and intelligence to help you manage financial crime risk efficiently and effectively - without slowing down your business. Whether you’re an individual, small business, or large corporation, our end-to-end AML and KYC solution enables you to screen new partners, monitor investors, and investigate high-risk entities with ease. From early red flag detection to regulatory alignment, Themis equips you to make informed decisions - fast, confidently, and all in one place.

Investigations completed in minutes, not weeks.

No compliance expertise required

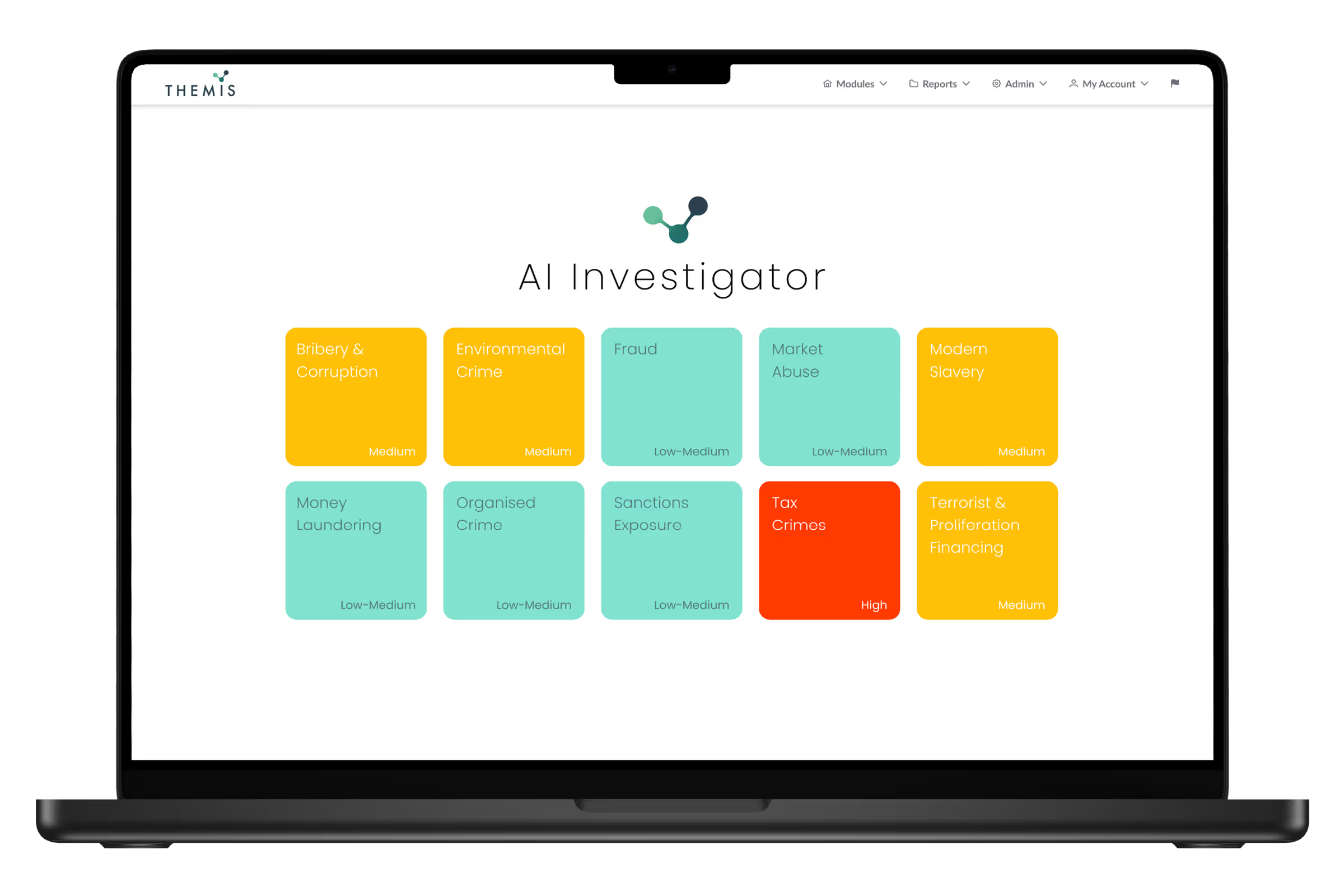

Clear, simplified picture of risk across ten financial crime risks

AI Investigator transforms due diligence through a team of AML-trained AI agents that gather, screen, and analyse data in parallel. Delivering verified, source-backed insights within minutes, it uncovers hidden risks and ownership structures. No expertise needed—just clear, transparent intelligence that makes enhanced diligence simple, seamless and instinctively secure.

Perform biometric facial recognition

Document verification for authenticity of passports and other forms of ID

Cross-check identity data against global watchlists and sanctions databases

Themis eIDV confirms identity using biometric checks, document verification, and global watchlist screening. It speeds up onboarding, supports KYC/AML compliance, and reduces fraud—providing secure, seamless digital identity validation without the need for manual document handling.

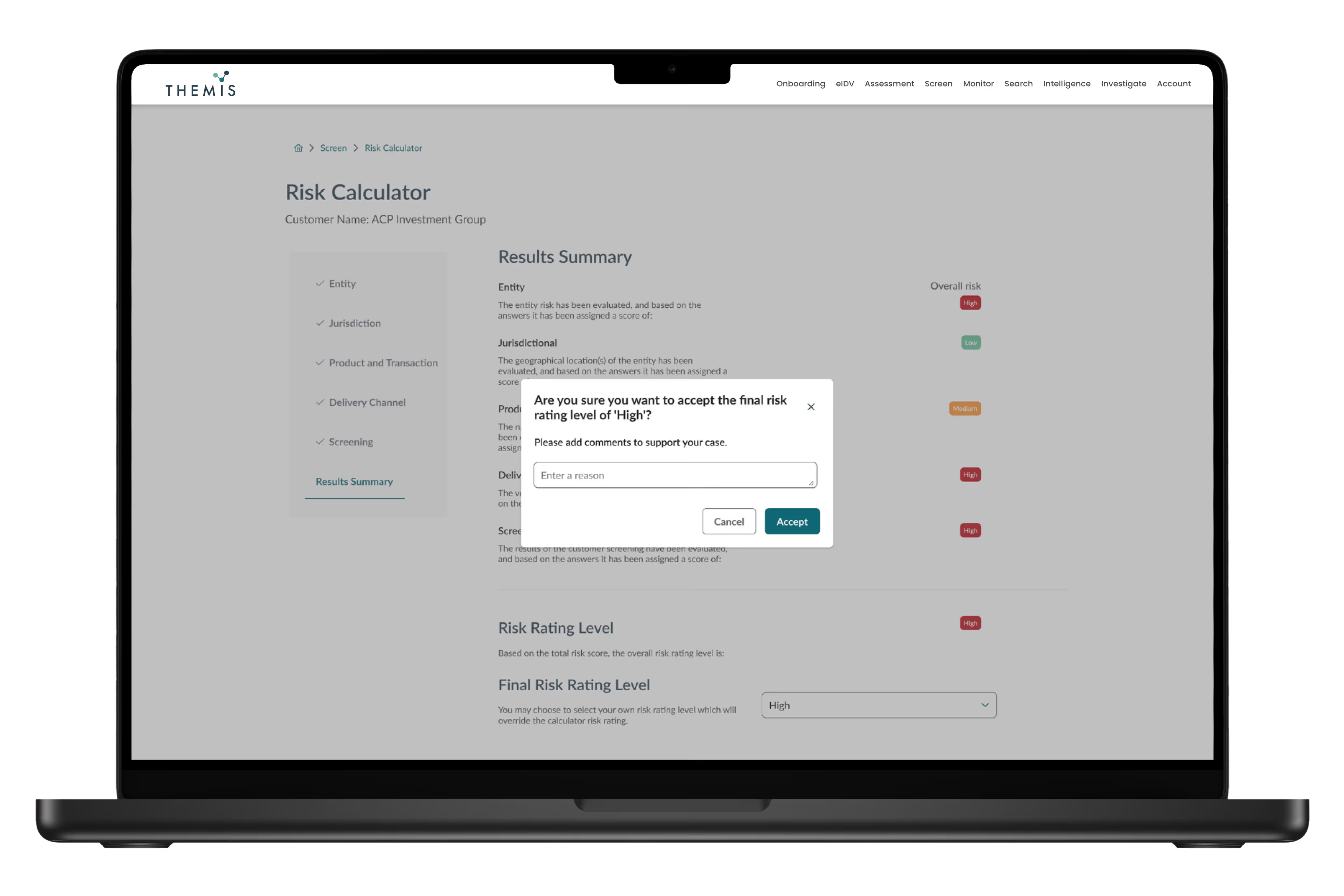

Instantly assess risk across clients and third parties

Generate clear, actionable risk scores in minutes

Prioritise exposure and streamline onboarding decisions

The Customer Risk Calculator instantly evaluates financial crime exposure using Themis’s risk-scoring model. It provides fast, actionable insights during onboarding or review, helping teams prioritise risks, improve decision-making, and allocate compliance resources more effectively.

End-to-End Digital Onboarding

Identity & address verification

Customisable workflows & approvals

A fully digital and automated solution designed to simplify and accelerate the entire customer onboarding process. It offers robust identity and address verification alongside customisable workflows and approvals, ensuring your organisation meets all compliance requirements efficiently. Onboarding streamlines KYC, KYB, and risk assessments within a scalable framework — reducing operational costs and minimising manual errors. This means faster onboarding times, improved customer experience, and a stronger foundation for regulatory adherence.

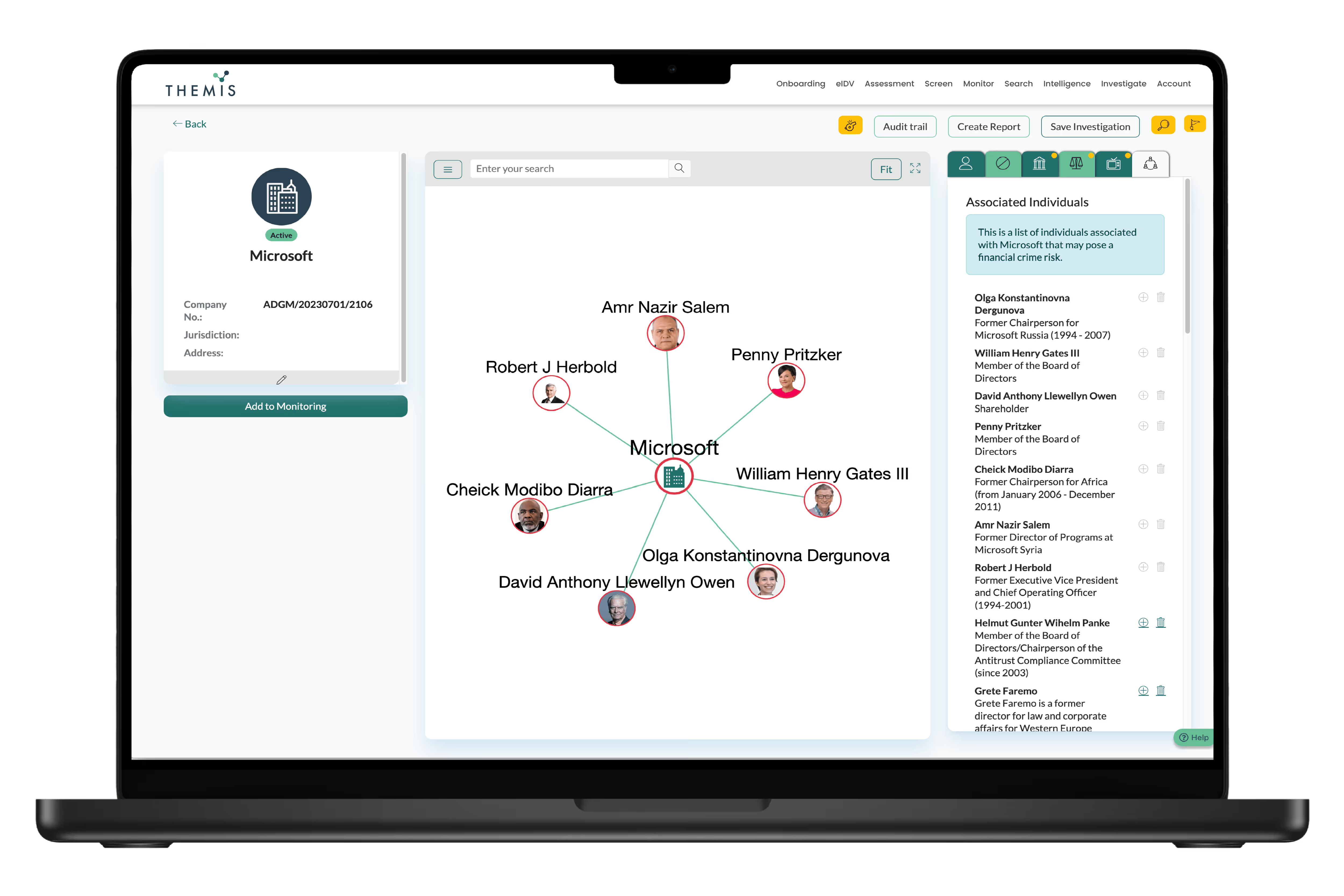

Search & investigate legal entities & individuals for links to financial crime

Unlimited Level 1 EDD Reports

Develop network risk maps

* Level 2 & 3 EDD reports available on individual pricing

Investigate enables in-depth research into individuals or entities. Generate unlimited Level 1 EDD reports, access advanced reporting, and visualise complex connections through network maps—ideal for uncovering hidden risks and strengthening compliance decisions.

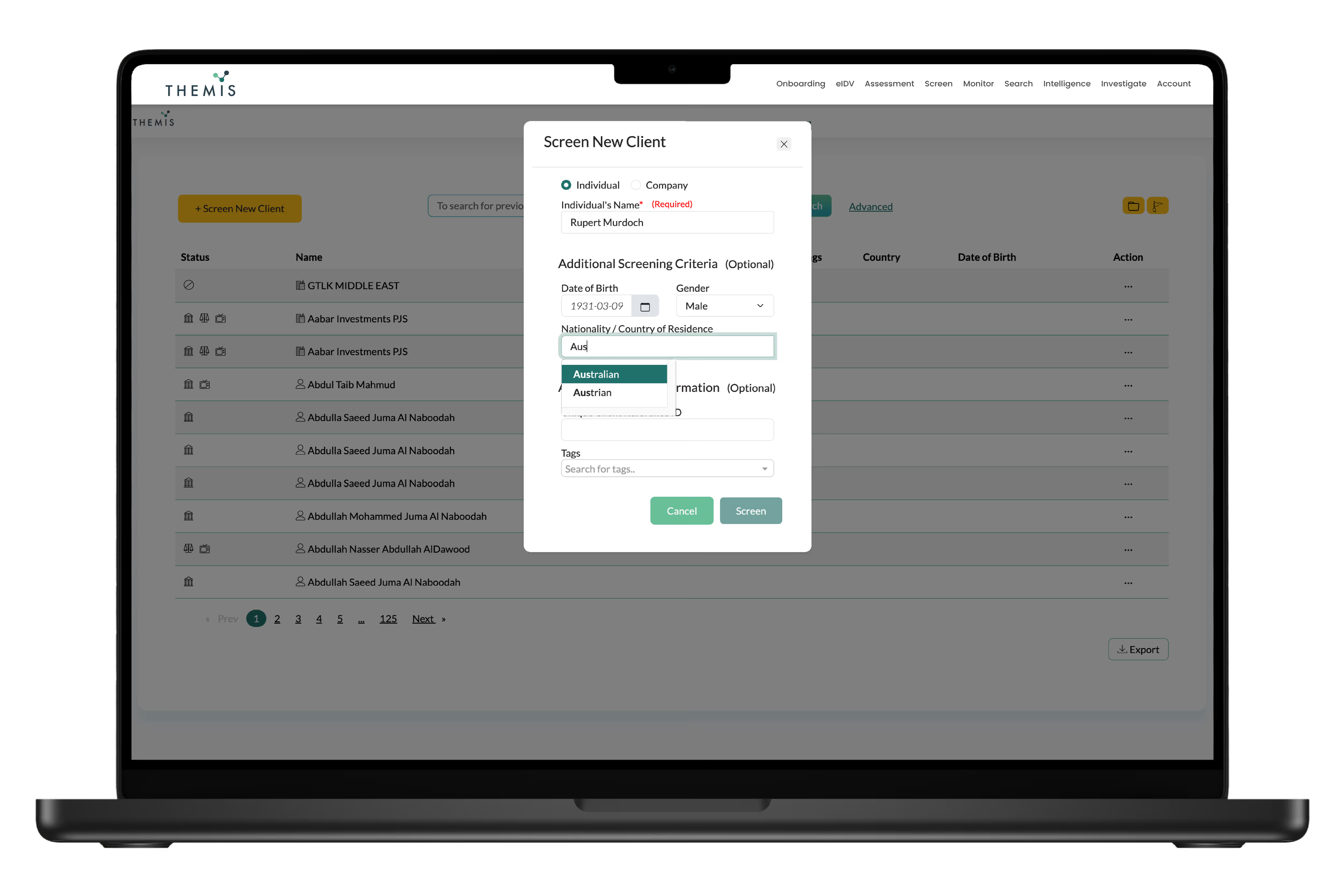

Screen a tailored number of entities, per year

Screen against sanctions, PEPs, litigation, adverse media outlets

Search against watchlist data

The Screening module checks clients, suppliers, and partners against global sanctions, PEPs, and adverse media. Real-time alerts identify high-risk entities early, supporting compliant onboarding and reducing reputational and regulatory risk across all business relationships.

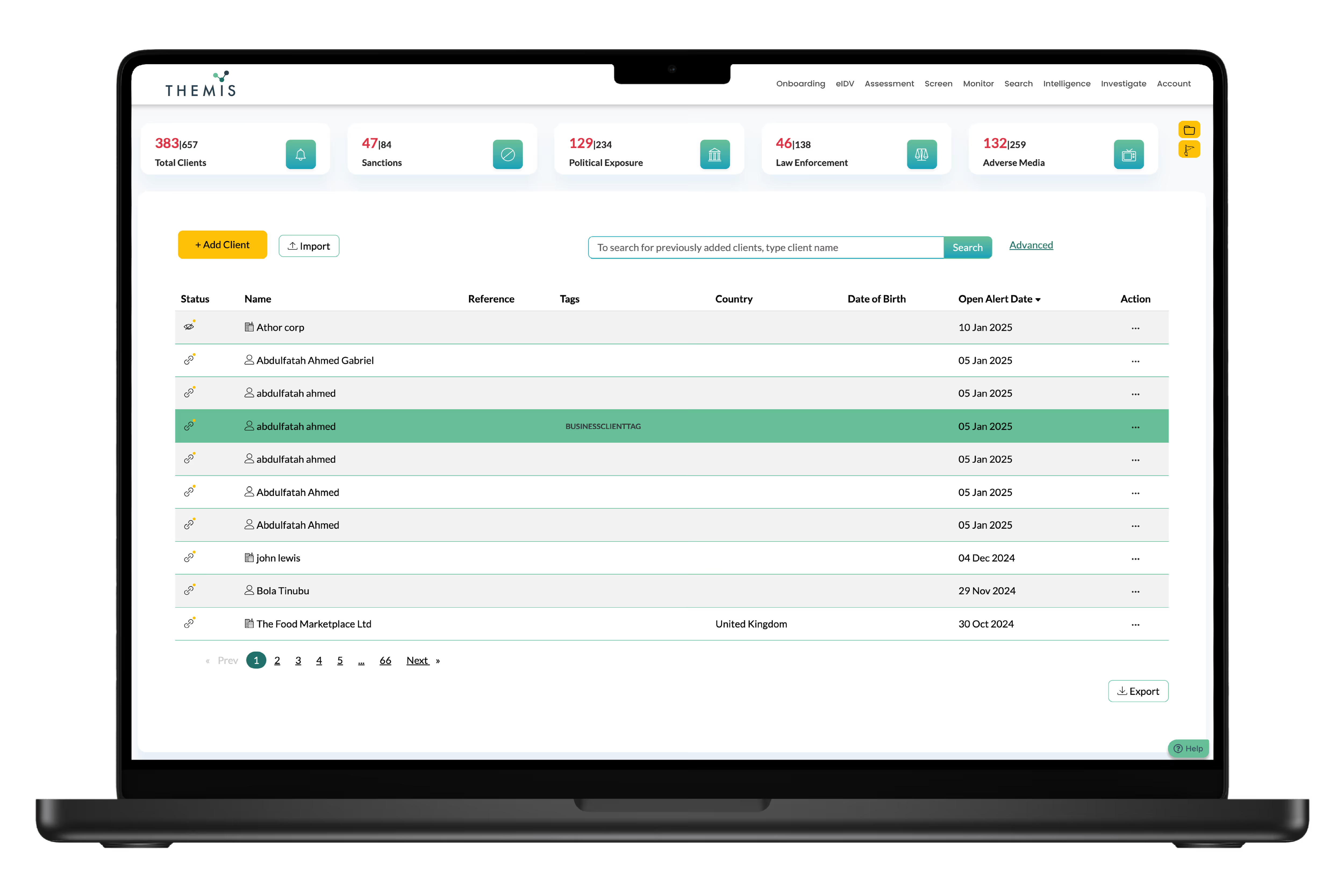

24-hour ongoing monitoring of legal entities and individuals

Batch upload data

Sanctions watchlists updated every 6 hours

Monitoring offers 24/7 tracking of clients and entities, with updates every six hours. It flags new risks through alerts and simplifies batch uploads, ensuring your compliance team stays ahead of emerging threats and changing risk profiles.

Bespoke Enhanced Due Diligence reports

Level 2 & 3 repository, all-in-one secure location

Audit trail capability

This module delivers expert-crafted Level 2 and 3 EDD reports, stored securely with full audit trails. It transforms risk data into actionable intelligence for high-stakes decisions, helping your business meet compliance standards with confidence.

Integrate real-time screening into your existing systems effortlessly

Access trusted risk data instantly to enhance decision-making

Automate compliance workflows and reduce manual processing

Integrate our screening, monitoring, and risk tools directly into your systems to automate due diligence and support compliance at scale. We offer two API options:

Standard : A quick-start, plug-and-play solution for basic screening and monitoring.

Premium : A full REST API with advanced features, ideal for enterprise-level integrations and complex workflows.

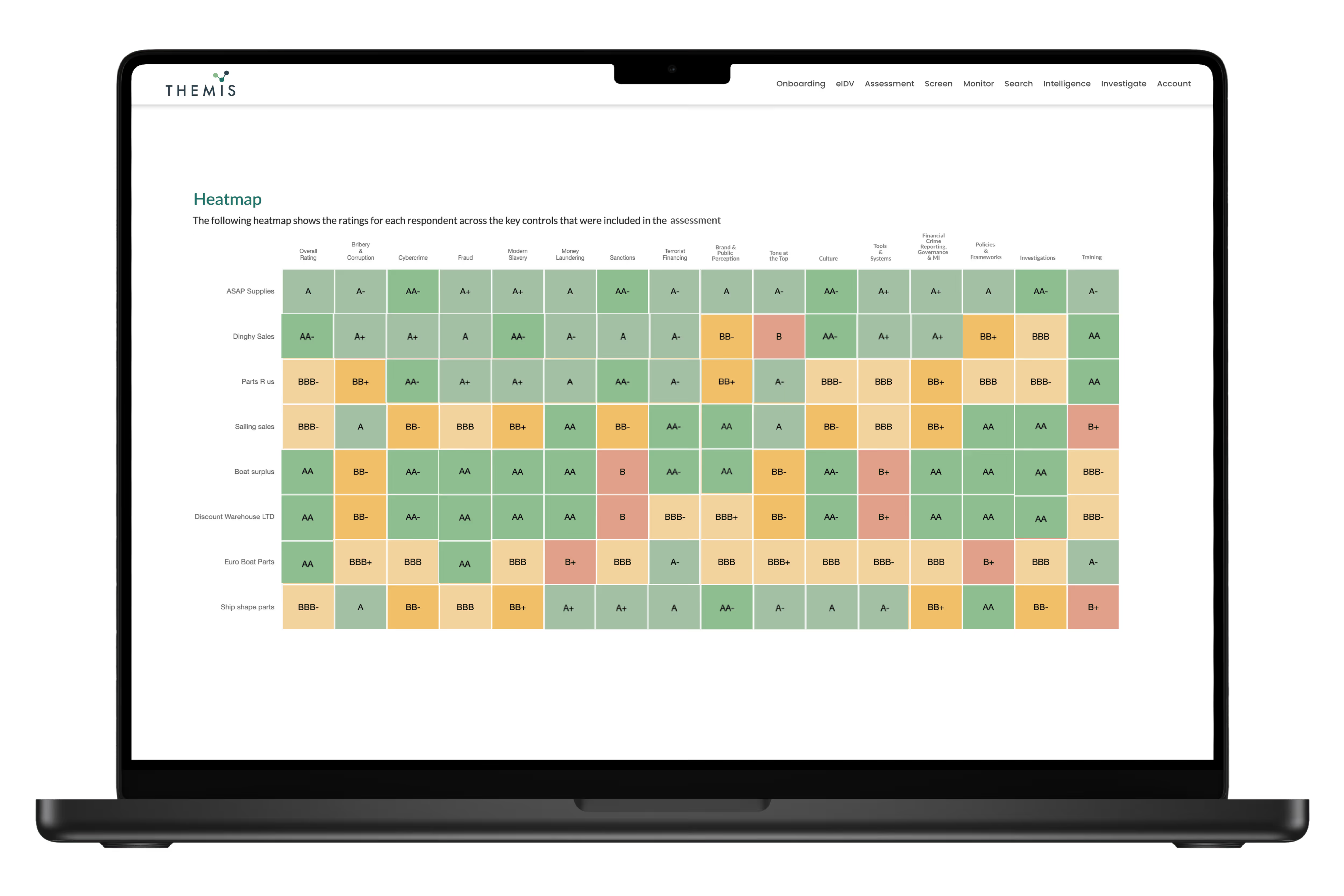

Meet your legal & regulatory requirements for outsourcing arrangements

Get a holistic view of all of your 3rd party risk in one heat map

Stay alerted to changes with ongoing monitoring

Risk Assessment gives a real-time view of third-party risk via heat maps and alerts. It meets regulatory requirements, prioritises high-risk relationships, and helps businesses manage outsourcing exposure with clarity and control.

Get instant access to essential due diligence tools — no complexity, no steep learning curve.

Quickly screen individuals and companies, ensuring your business remains compliant and secure.

Themis continues to expand its AI capabilities to fight financial crime, powered by a prestigious Innovate UK grant. This project revolutionises how companies detect and report criminal links, strengthening Themis’ leadership in compliance innovation and its commitment to excellence.

Customer Success goes beyond support - it’s about partnership, guidance, and proactive problem solving. It’s that personal touch that ensures you’re not just using our platform, but maximising its value.

Our dedicated Customer Success team is here to understand your evolving challenges, tailor solutions to your needs, and provide expert insights that help you navigate financial crime risks with confidence. Whether it’s onboarding, ongoing support, or adapting the platform as your business grows, we’re with you every step of the way.

Your financial crime risk profile is unique to your business and will evolve over time. We understand this, and we’ll work with you as your business grows to modify, adapt, and evaluate new functionality & customisations, helping your business stay resilient and ahead of emerging threats.

Enterprise includes all features from Core and Extended, plus full API access, custom integrations, dedicated account management, and enterprise SLAs.

Large enterprises, financial institutions, and multinational compliance teams requiring deep customisation.

Yes, it supports custom workflows, integrations with internal tools, and flexible configurations.

Yes, dedicated account managers and 24/7 SLA-based support are standard.

Yes, SSO and advanced user management are included for security and access control.

Yes, Enterprise clients can define and apply bespoke risk models.

Yes, user limits are flexible and scalable based on organisation size.

Enterprise supports deployment in secure, private environments upon request.

Every business faces different risks, which is why we offer flexible plans designed to fit your needs - whether you need essential screening, ongoing monitoring, or advanced risk intelligence. Compare our plans below to see which level of protection is right for you, with the option to upgrade anytime as you grow.

Ensure data sovereignty and compliance by keeping your searches within UAE borders—no data leaves the country.